This story is part of Forbes' coverage of Singapore's Richest 2020. See our full coverage here.

SEAN LEE FOR FORBES ASIA

Consider these facts: Singapore-based Sea Ltd. is the most valuable public company in the island nation, with a market capitalization of around $69 billion as of Aug. 19. At $7.1 billion, Forrest Li, Sea’s chairman and cofounder, has a net worth that puts him at No. 7 on Singapore’s 50 Richest list, up from No. 21 last year. The company’s two other cofounders, David Chen and Gang Ye, are also billionaires.

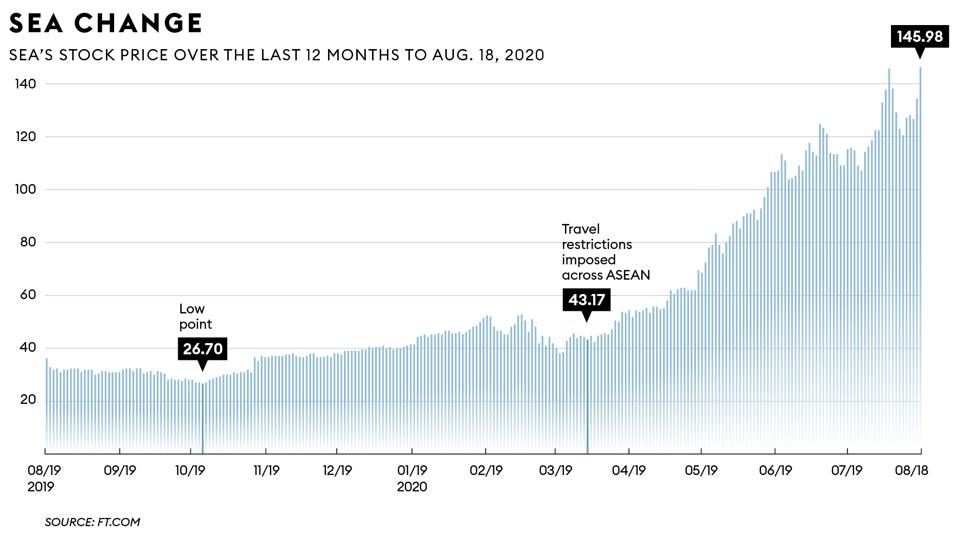

While the pandemic has decimated many companies, it is a boon to others, and few better illustrate this than Sea. The company’s three main businesses have seen demand skyrocket in the new normal: e-commerce, online gaming and digital payments. And Li says the growth is just starting: “You don’t see the ceiling on these three businesses.” Investors agree, as Sea shares have more than tripled this year to around $146 (and are up over 1,000% since early last year).

Sea’s second-quarter earnings, released on Aug. 18, show how well it has been faring. Total revenues nearly doubled to $1.3 billion—driven by big revenue gains at its two largest businesses, online gaming and e-commerce, jumping 62% to $716 million and almost tripling to $511 million, respectively. The company, however, remains unprofitable, with its second-quarter losses widening 59% to $373 million year-on-year.

Sea’s success is also a validation of Li’s belief in Southeast Asia’s digital future. Li says the pandemic only accelerated a disruption already in place. “Several years down the road, when we look back at this situation, I think we’ll see this digital transformation during this pandemic was very broad and very deep and, in our view, irreversible,” says Li in a video interview from Sea’s office in Galaxis, a high-tech business park in Singapore.

Li, who holds an engineering degree from Shanghai Jiaotong University and an M.B.A. from Stanford University, has come a long way in his 42 years. He was born and raised in the Chinese port city of Tianjin by parents who spent their entire careers at state-owned companies. After being a recruiter for Motorola and Corning in Shanghai for four years, Li realized he wanted to do something more with his life after studying hundreds of résumés. “Every résumé is a personal story, right? So by reading other people’s stories, I started to think about how I wanted my résumé to read like in the future,” he told Forbes Asia in 2015. “I kind of knew what my résumé would look like five years later. And somehow I didn’t feel excited.” His first step to make a change was getting accepted into Stanford, where he met his future wife Ma Liqian.

Garena’s Free Fire World Series 2019 drew more than 130 million views online. The battle ... [+]

Courtesy of SeaIn 2005, Li attended Ma’s graduation, where Steve Jobs delivered his famous “you’ve got to find what you love” commencement speech. Jobs inspired Li to pursue his passion for online gaming, so he launched a gaming company called GG Game in Singapore, where he had moved with Ma. The startup failed. Undeterred, he launched Garena in 2009 with Chen and Ye—all three are now naturalized Singaporeans originally from mainland China.

But keeping this second company alive proved a struggle, as Asia was still reeling from the global financial crisis. The company turned a corner in 2010 when it signed a deal to distribute games from U.S.-based Riot Games and Tencent took a 40% stake in the company, giving Sea a big cash infusion (now reduced to 20%). The next step in Sea’s evolution came in 2014, when it launched AirPay, which evolved into Sea’s digital financial service SeaMoney. The next year, it ventured into e-commerce with the launch of Shopee.

American Nick Nash, the former group president of Sea from 2014 to 2018, says these steps were part of Li’s plan to create a company inspired by Alibaba and Tencent for the Southeast Asian market. “Southeast Asia’s evolution is in many respects similar to China, but happening about 11 years later,” says Nash, now cofounder and managing partner of Asia Partners, a Singapore private equity firm investing in Southeast Asian tech firms. “The brilliance of Forrest’s strategy was very clear,” Nash says: “an opportunity to locally adapt and be inspired by the two most valuable business models from China—online games from Tencent and e-commerce from Alibaba.”

In 2017, Li rebranded the company as Sea ahead of its IPO that year—the new name was a nod to Southeast Asia, the company’s main market. Sea raised $884 million in an offering that valued the company at more than $4 billion when its shares listed on the New York Stock Exchange. “Connecting the dots” became Sea’s tagline, a phrase taken from Jobs’ 2005 speech.

With so many at home or keeping social distance, going online is now the main way to engage with others, says Li. Sea’s online gaming business, which retains the Garena name, had a strong start to the year, with half a billion active users in the second quarter, up 61% from the previous year. That growth was fueled by the popularity of Free Fire, a battle royale-style multiplayer game. According to researcher App Annie, it was the third most-downloaded mobile game globally in the second quarter from the Google Play app store.

Sea’s Shopee business saw similar pandemic-fueled growth, as shoppers stocked up on supplies. “The first thing for consumers is to buy the things they need,” says Li. In the second quarter, Shopee had gross merchandise value growth of 110% from the previous year to $8 billion, while gross orders totaled 616 million, a 150% increase year-on-year. Shopee was the most downloaded shopping app in Southeast Asia and among the top three worldwide in the same category in the first half of the year, according to App Annie.

To be sure, Shopee is still losing money, even after five years of operation. Sea’s e-commerce division’s operating loss widened to $345 million in the second quarter from $270 million a year earlier. Shopee’s costs arise from its expensive battle to gain and keep market share from multiple rivals, such as Alibaba’s Lazada and Indonesia’s Tokopedia (which is also backed by Alibaba). Shopee’s net loss is the main reason why Sea remains unprofitable (Garena, meanwhile, had operating income of $167 million on $384 million in revenue in the latest quarter).

Forrest Li

Sean Lee for Forbes AsiaBut Southeast Asia’s e-commerce market is still growing—less than half of the region’s 360 million internet users actively shop online, according to a report last year jointly prepared by Google, Temasek and consultancy Bain. So for now, gaining market share trumps making money, says Sachin Mittal, head of telecommunication, media and technology research at DBS in Singapore. “Shopee’s losses are reasonable at this stage as market share is the priority over profitability at such low e-commerce penetration levels,” he says.

Li says Shopee can break even any time. Yanjun Wang, group chief corporate officer, told analysts in a May conference call: “We are focused on investing in growth, in extending our market leadership that will bring us much better return in longer run and profitability.”

Sea’s third business is SeaMoney. The digital financial services arm is the smallest of Sea’s business units, with second-quarter revenue of $12 million—about 1% of the company’s total revenue. Its value, for now, comes in helping facilitate other units’ operations, such as payments for Shopee. “We believe that digital payment is a very important infrastructure,” says Li. In July, for example, 45% of Shopee’s gross orders in Indonesia were paid using SeaMoney’s mobile wallet service.

SeaMoney has the potential to be a significant business by itself. Second-quarter revenue more than quintupled from just over $2 million a year ago. The Southeast Asian digital payments market is expected to reach $1 trillion by 2025—accounting for half of all payments in the region, according to the Google, Temasek and Bain report. Similar to online shopping, Li expects the coronavirus will push more people toward digital payments.

Sea’s headquarters in Singapore.

Sean Lee for Forbes AsiaA possible addition to SeaMoney could be a game-changer: digital banking. Earlier this year, Sea applied for one of the two digital retail banking licenses in Singapore. Like a traditional bank, the license would allow Sea to make loans and take deposits. “The best way to make money in the lending business is by having consumer deposits, which lower your cost of capital,” says Nash. “Having a bank license would give Sea access to a wonderful base of deposits here in the most important financial center of Southeast Asia.” The Monetary Authority of Singapore is assessing five applicants, including Sea, and is expected to award the two licenses by year-end.

Outside of digital banking, Li has no immediate plans to branch out beyond Sea’s three main business lines. “We always believe that digital entertainment, specifically games, e-commerce and digital financial services are the largest [internet] categories,” says Li.

Li says Sea is entering a new phase in its evolution, having graduated from its frenetic early startup days. “We’re not in a rush to look for some new things to grow. That is very, very different from six, seven years ago, when we did have that urgency,” says Li. “We’re going to remain very focused on the three lines.” Still, Li says he is keeping an eye on any new opportunities, including online food delivery, e-learning and telemedicine.

Over the long term, as Sea continues to grow, it is starting to move outside Southeast Asia. Li points to Garena, where more than half of its online gaming users come from outside the region, including India, Latin America, the Middle East and Russia. “If we have the opportunity to serve more users globally, we do have that aspiration,” Li says. But he insists that Southeast Asia will remain Sea’s priority. When asked if he will change Sea’s name to reflect the company’s global ambitions, Li says, with a laugh: “We don’t have that plan at the moment.”

Three-Comma Club

(From left) Forrest Li, Gang Ye and David Chen.

COURTESY OF SEADavid Chen is the third and last of Sea’s founders to join the ranks of billionaires. Chen, 39, became a billionaire in mid-June when the Singapore-based gaming and e-commerce firm’s share price passed $97—up 547% from its IPO price. Chen’s stake in the company, plus options, puts his personal fortune just north of $1 billion.

Chen is the fourth-largest individual shareholder in Sea after fellow cofounders Li and Ye, the first and second-largest. Independent director and early investor Kuok Khoon Hua, the youngest son of Malaysian billionaire Robert Kuok, is the third-largest.

Chen holds a strategic position as the chief product officer of Shopee, a sign of the importance of e-commerce to the company. He is the only cofounder focused on a specific business (Li is group CEO and Ye, 40, is group chief operating officer).

Sailors at Sea

Courtesy of Sea

Beyond his digital aspirations, Li is an avid soccer fan and has plans to elevate the city-state’s soccer scene. There’s lots of room for improvement: the Lions, as the men’s national team is nicknamed, are ranked No. 157 in the world by FIFA, below New Caledonia in the South Pacific. Li, who sits on the Football Association of Singapore Council, is focused on developing young players. “If kids are really passionate about football and they are gifted, we want them to continue on that path and show them that being a professional footballer could be a very valid career, which is the case in a lot of Europe, but less so in Asia,” he says.

Li is doing that through Lion City Sailors, a local professional club formerly named Home United that Sea acquired in February from the Singapore government for an undisclosed sum. (It was the first privatization of a Singapore Premier League club as part of a pilot project by the Football Association of Singapore to revitalize the league.) He took over as chairman and announced in June that the club would build a world-class center to train talented youth.

Li doesn’t rule out other soccer-related purchases down the line, even a European soccer club. “We don’t have any plans at this moment, but we will see,” he says with a laugh. If he did, he’d be joining an elite club of Asian tycoon owners, including Singaporean Peter Lim (Valencia), Malaysian Vincent Tan (Cardiff City) and Thai Aiyawatt Srivaddhanaprabha (Leicester City).

Li, who says he is both a Barcelona and Arsenal fan, also admires soccer superstar Cristiano Ronaldo, who plays for Italian champions Juventus. Last year, Li hired Ronaldo to be Shopee’s brand ambassador.

The Link LonkAugust 20, 2020 at 04:34AM

https://ift.tt/2Qaald6

Forrest Li’s Sea Ltd Surges As Pandemic Drives Digitalization Across ASEAN - Forbes

https://ift.tt/2CoSmg4

Sea

/cloudfront-us-east-2.images.arcpublishing.com/reuters/CZF6NULMVVMEXHOP7JK5BSPQUM.jpg)

No comments:

Post a Comment